Key Points:

- Google Cloud has just launched GCUL, a blockchain for payments, tokenisation, and settlement.

- Stablecoins drove $30 trillion in transactions last year, more than Visa’s annual volume.

- GCUL promises low fees, compliance, and better integration for banks and institutions.

The Google Cloud Universal Ledger (GCUL) has just been launched. This Google platform was designed to improve cross-border payments and settlements. According to reports, unlike retail-focused crypto networks, it is aimed at traditional enterprises.

The Rise of Stablecoins and Demand for New Rails

Many payment systems rely on old rails that are slow, expensive, and difficult to upgrade. This has led to demand for faster, programmable, and more reliable payments.

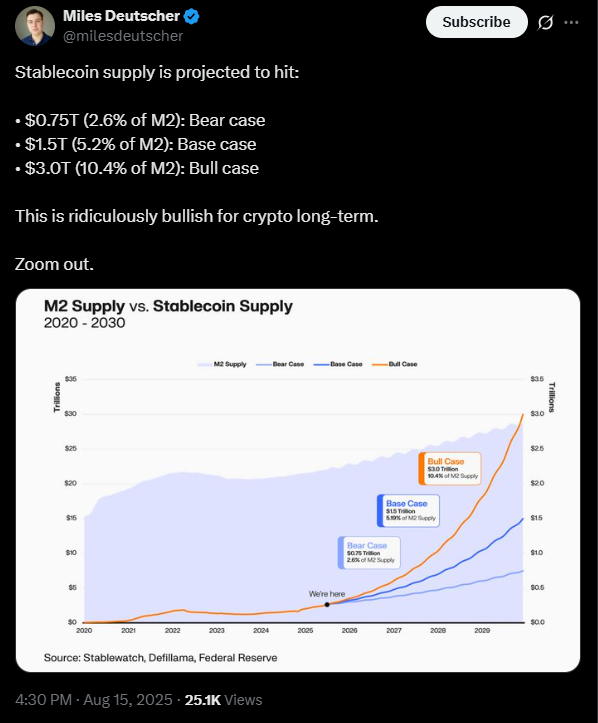

Because of this, stablecoins have quickly become a major part of digital finance. For example, last year, total settlement volume reached $30 trillion. This means that it more than doubled from the previous year.

That figure exceeded Visa’s $13 trillion annual payment volume and dwarfed PayPal’s $1.6 trillion. Dollar-backed stablecoins account for over 1% of the U.S. M2 money supply. Also, they are expected to expand over the next few years.

Stablecoins have come a long way from being mere experiments. Instead, they have become a significant financial rail because they easily support fast and cheap transfers. Markets are also looking into stablecoins for trade settlement because of their better transparency and faster clearance.

The Problem with Legacy Payment Methods

Fragmented systems are currently slowing down international finance. Each region has its own rails and standards. This means that cross-border payments have become slow and expensive. More importantly, they are dependent on correspondent banks.

The numbers also show how massive the problem has become. For example, $37 billion was spent maintaining outdated systems in 2022. It is predicted to rise to $57 billion by 2028.

Inefficiencies may reduce global GDP by $2.8 trillion in the next five years, likely costing 130 million jobs. Per the WSJ, a retailer like Walmart could save $8B annually in card processing fees if it had cheaper rails.

At the same time, 75% of banks struggle to launch new services because of their outdated infrastructure. This gives fintechs that support stablecoin integration a competitive edge.

Introducing Google Cloud’s Universal Ledger

GCUL is Google’s answer to these challenges. It is a planet-scale, permissioned blockchain designed to provide modern payments. It is simple to use because it works like a cloud service with a single API. Moreover, its integration across multiple currencies is smooth, and fees are predictable..

This platform is also flexible and programmable. It also works well with several wallets. It even supports automation and tokenisation.

Finally, it runs as a private ledger with KYC and audit trails. In other words, it is compliant by default. The GCUL offers cheaper fees, faster settlement, and is available 24/7.

Why GCUL Is Great For Capital Markets

Today, many capital market trades take days to settle. They tie up collateral and raise counterparty risk. Meanwhile, GCUL can shorten settlement cycles and unlock liquidity on a massive scale.

This new platform supports assets like bonds, funds, and collateral, and could be the answer to modern market issues. The system makes sure that settlement assets are tied to commercial bank money. This ensures that its operations have regulatory clarity and avoid disintermediation.

Ripple, Circle, Stripe, and others

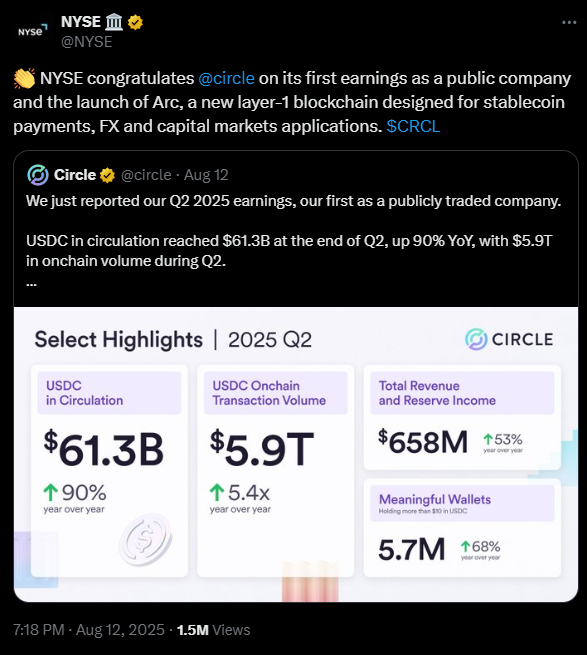

GCUL has just entered a crowded field. Circle is testing Arc. It is a blockchain that makes USDC its native gas token. Stripe is building Tempo, a network tied into its existing payment stack.

Meanwhile, Ripple is pushing for the adoption of its XRP Ledger, especially for tokenisation and cross-border settlement.

Conversely, Google has provided GCUL as a scalable and neutral competitor to all of the above. Moreover, Google has billions of users and hundreds of institutional partners. GCUL has a natural advantage because any bank, fintech, or stablecoin issuer can build on it.

Leave a comment