Key Insights

- HYPE climbed 21% in one week and retested the $50 resistance zone.

- Whales recently purchased $18 million worth of HYPE, a strong show of confidence.

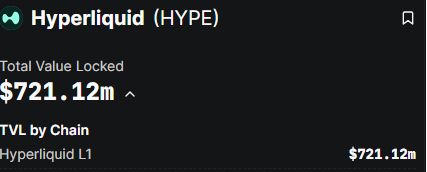

- Hyperliquid’s TVL reached $721 million in August, its highest this year.

The price of Hyperliquid’s HYPE recently rallied past $50. The token has surged 21% this week and nearly 12% in the past day. Its trading volume has also shot up above $522 million.

This level had previously been a significant resistance over the last few weeks. Earlier break attempts ended in fast pullbacks. Analysts now believe that if the traction holds, HYPE could target $55 next.

Bounce From Accumulation Zone Sparks Momentum

The rally started with a rebound from the $43 to $45 accumulation zone. There, buyers stepped in and bought many tokens. This zone eventually became a base for the ongoing leg up.

HYPE is now trading well above its short-term averages. The 9-day EMA is $46, and the 50-day SMA is $44. The asset’s current price holds above both, and the short-term market structure is bullish.

The token has also re-entered its upward channel and shows buyers may be preparing for another move toward $55.

Whales Buy $18 Million in HYPE As TVL Surges.

Whale activity has been another source of market movement lately. According to market data, two wallets recently accumulated 358,279 HYPE, worth more than $18 million.

Analysts note that large holders tend to set up positions early when they see a promise of strength. These moves influence market direction, especially when backed by strong technical signals.

According to DefiLlama, Hyperliquid’s total value locked (TVL) reached $721 million in August. This stands as the highest level this year and shows the ongoing participation within the protocol.

TVL started the year under $200 million. It peaked at $600 million in February and fell to nearly $300 million over the following months. However, capital inflows have returned since May, pushing TVL to new highs in late August.

The increase in locked capital has lent strength to Hyperliquid’s position in the DeFi sector, and demand is likely to continue..

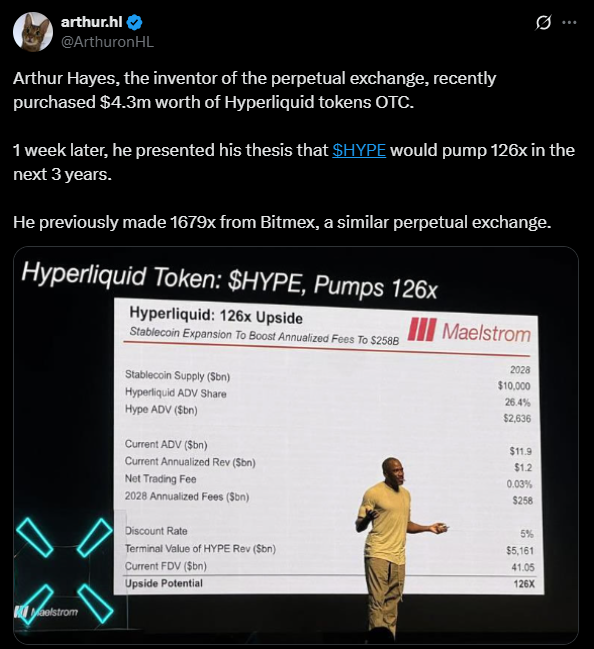

Arthur Hayes Calls HYPE a Generational Bet

Arthur Hayes, the co-founder of BitMEX, has also amplified the bullish sentiment. Hayes spoke at the WebX conference in Tokyo earlier in the week. He predicted decentralised exchanges could see annualised fees rise to $258 billion.

This is a massive rise, compared to $1.2 billion today. He pointed out Hyperliquid’s role in this expansion. He also noted that HYPE could surge 126 times its current price within the next three years.

His comments immediately kick-started heavy trading, and the token briefly touched $47 before stabilising near $45.

While some whales accumulated, others took profits. One address sold over 886,000 HYPE worth $39.6 million to fund a prominent leveraged ETH position. This move added volatility to the mix, but did not derail Hyperliquid’s strength.

Weekend trading volume on Hyperliquid DEX also jumped to $1.56 billion, a record high. Transaction fees in August also beat July’s record at $93 million and showed rising demand for its services.

Can HYPE Sustain Its Momentum?

HYPE price surge above $50, combined with whale accumulation and high TVL, indicates the project is entering a stronger growth phase. Breaking past $55 would open the door to higher levels around $56.

However, the $46 support could still offer some relief if momentum falters. Now that the whales are active, and institutional interest is rising, HYPE is well-set for more strength gains over the next few months, even without mentioning its DEX gaining market share.

Leave a comment